Services & FEES

INVEST WITH CONFIDENCE

Our services, models and decisions are typically built upon the foundations of Modern Portfolio theory, Security and Investments analysis. In general, we take a long term approach to investing, and strive to build an investment portfolio for our clients creating real long term wealth.

Investment Plan Services

Our investment advice is tailored to meet our clients' needs, investment objectives and suitability standards. Our clients engage us to develop an investment plan for them that can address their short term, mid term and long term goals. We use our advanced knowledge in investments, portfolio allocation methods and your personal goals for planning purposes. We will provide you a comprehensive plan that you can self-manage.

Portfolio Management Services

If you retain our firm for portfolio management services, we will meet with you to determine your investment objectives, risk tolerance, and other relevant information at the beginning of our advisory relationship. We will use the information we gather to develop/discuss a strategy and plan that enables our firm to give you continuous and focused investment advice and/or to make investments on your behalf. As part of our portfolio management services, we may - Recommend a custom investment portfolio for you according to your risk tolerance, investing objectives & preferences, or - Recommend investing your assets using a predefined strategy, or using a pre-defined model portfolio(s) developed by our firm. Once you review the recommendations and make a decision, we will construct the investment portfolio for you and will monitor your portfolio's performance on an ongoing basis. From time to time we will recommend rebalancing the portfolio as required to address changes in market conditions and in your financial circumstances to continue to get you the optimum return/risk outcomes.

Client Engagement Process

We do not take custody of your funds and/or offer investments on a discretionary basis. Our 8 step process is simple and structured.

- Client Interview to understand investment objectives, risk tolerance and other relevant information at the beginning of the advisory relationship

- Develop/discuss a investment strategy or plan that enables our firm to give you continuous and focused investment advise and/or to make investments on your behalf

- Recommend a custom investment portfolio or proposed investing in a pre-defined model portfolio

- Client reviews recommendations and makes a decision

- We construct an investment portfolio.

- Performance monitoring on an ongoing basis

- Rebalancing recommendations for market conditions and your own financial circumstances

- Scheduled investment allocation account reviews

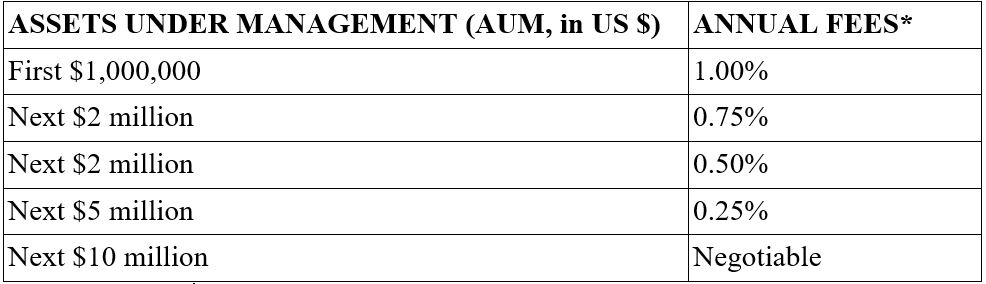

Fees

An independent review & consult on an existing holdings & plan will be assessed at a fixed amount of $250 per hour with a basic package of a 3 hours review. These fees will be waived off should client choose to post a review, have existing assets under management (AUM) by the firm using its investment advisory & portfolio management services per fee table below.

- For a client with AUM USD $500,000 the annual fees would be USD $5000